How are Alternative Asset Classes Responding in Today's Volatile Environment (and where are the Potential Opportunities and Dangers)?

- Mar 31

- 11 min read

Rapidly evolving events have stunned many public and private investors and challenged their portfolios. But change also brings opportunity. So where are the potential opportunities (and dangers) in alternative asset classes, today? We'll look at the red-hot private lending class, various real-estate sectors that could be poised for a break-out and bitcoin.

(Usual disclaimer: I'm just an investor expressing my personal opinion and am not an attorney, accountant nor your financial advisor. Consult your own financial professionals before making any financial decisions. Code of Ethics: To remove conflicts of interest that are rife on other sites, I/we do not accept ANY money from outside sponsors or platforms for ANYTHING. This includes but is not limited to: no money for postings, nor reviews, nor advertising, nor affiliate leads etc. Nor do I/we negotiate special terms for ourselves in the club above what we negotiate for the benefit of members. Info may contains errors so use at your own risk. See Code of Ethics for more info.)

As we head into the second quarter of 2025, many investors feel stressed-out and challenged. They’re grappling with what feels like a never-ending series of changes. And they’re wondering how much it will damage their investment nest-eggs.

But challenges also come with opportunities. So where are the potential opportunities (and pitfalls to watch out for)?

This article looks at the macro-economic factors currently affecting investments and how several alternative asset classes have been doing. And it also talks about where future opportunities may lie...and where potential dangers may lurk.

Navigating the winds of change

It’s completely understandable that so many investors are feeling a bit shell-shocked. After all, they've endured an unprecedented series of events over the last several years. And many were surprises that few predicted in advance.

Inflation appears to be coming back

After the Covid 19 lockdowns and fiscal stimulus, inflation spiraled out of control across the world. And this lasted for several years and threw many markets into chaos. Finally, the Fed tamed the inflation beast and achieved the virtually mythical, holy-grail of central banking. That was a "soft landing" (which is when the fed raises and lowers interest rates without causing a recession). Unfortunately in the last few months, inflation has again reared it’s ugly head. And yesterday, stocks tumbled after the latest inflation print came in unexpectedly very hot.

Core inflation (the index of Personal Consumption Expenditures which strips out volatile food and energy components) rose 0.4% in February. That was the biggest gain since January 2024 and followed an unrevised 0.3% advance in January.

James Knightley, chief international economist at AIG, said:

“We are moving in the wrong direction and the concern is that tariffs threaten higher prices, which mean the inflation prints are going to remain hot. This will constrain the Fed’s ability to deliver further interest rate cuts,”

Interest rates

These have also gone through crazy gyrations.

For many decades, investors enjoyed the "great moderation" as interest rates methodically moved lower and lower. Inflation ended this party and led to the most rapid rate increases seen in decades. After that, everyone expected rates to go back down (like in past cycles). Instead they became uncomfortably stuck in a "higher for longer" mode. This caused significant pain for some investments.

And more recently they've been modestly dropping.

However, as the AIG economist mentioned above, the concern is that inflation may again end the party, and much sooner than many would prefer.

Government policy

A new administration took control of the White House and Congress in January and has implemented policies that could significantly affect investments. Tarrifs tend to contribute to inflation. Mass-layoffs of the federal workforce contribute to unemployment, reduce consumer spending and might contribute to a business-cycle will downturn. And if campaign promises about immigration are implemented then this might also influence the macro-economic environment (and in turn, investments).

So in a rapidly changing environment, what's an investor to do?

"What, me worry"?

First, we’re going to only briefly mention those fortunate alternative investment asset classes which aren’t directly correlated to the business cycle.

These tend to generally keep humming-along obliviously to the stock market, the business cycle and macroeconomic factors. And so timing doesn't tend to matter that much.

One example is a GP stakes investment, which as investment in a financial fund manager. These typically generate significant predictable, recurring management fees and that occur regardless of economic factors.

Another example is litigation finance. These investments finance legal cases and performance is based completely on winning or losing in court. So the outcome has little to no connection to macro-economics and cycles.

So let's now focus on alternatives that are connected in some way. And where timing can be more important.

Private Credit / Debt

In the current environment, banks are lending less. So this allows willing, private investors to step-in and fill the gap. And returns can range from 8% - 13%+. So that can be a refreshing situation in an otherwise low-rate environment.

And if interest rates rise, floating-rate debt rises with it and returns even more.

As a result, private credit / debt has quickly become one of the most popular alternative asset classes with institutional and high-net-worth investors. With Intelligence says:

“2024 was another blockbuster fundraising year for private credit. After recovering from a slow start, the year finished at $209 billion of final closes – 5% higher than 2023. In 2025, investor appetite for direct lending shows no signs of slowing down and we expect another strong year for the asset class. If the recent trend towards ‘mega funds’ is anything to go by, fundraising will be concentrated among an ever smaller group of established, top-tier managers.

And as many businesses look for new ways to get funding, the move to private credit is very likely to increase in the coming years. Morgan Stanley projects private credit to soar to approximately $2.6 trillion by 2029 (from $1.5 trillion at the start of 2024)

Bloomberg, wrote a recent article on the topic called "An Investor’s Guide to Joining the Exclusive Private Credit Party"

And it talks about different way to access the asset class, including accredited investor offerings (like this one).

For non-accredited investors, there are also some big firms with new offerings to choose from, including Blackstone, Apollo and Carlyle. Bloomberg warns:

...They aren’t like the mutual funds or ETFs you’re familiar with: ... these assets are held in funds with more power to limit withdrawals to a set percentage of total assets each quarter. You may not be able to get your money out quickly, especially in a downturn when managers won’t want to be forced into a fire sale of assets—one quip in the industry is that such funds are liquid until they aren’t. Annual fees can be several times higher than for conventional funds."

Real Estate

Real estate has never historically been directly tied to the business cycle. But we’ll discuss it here anyway, because its own unique cycles have recently gone through a downturn and recovery. And many analysts believe this presents a unique buying opportunity.

Additionally, some real estate types (like multi-family) could be exceptionally well-positioned in a world of tariffs and trade wars.

What causes real estate prices to change?

Many people believe that real estate prices are directly correlated to interest rates. But history shows that this isn’t actually the case. Instead, real-estate has historically followed its own, unique cycles. And they’re called the financial and physical (or space) cycles.

The ups and downs of the last several years

2025 is currently shaping up to be a turnaround year for several major real-estate classes.

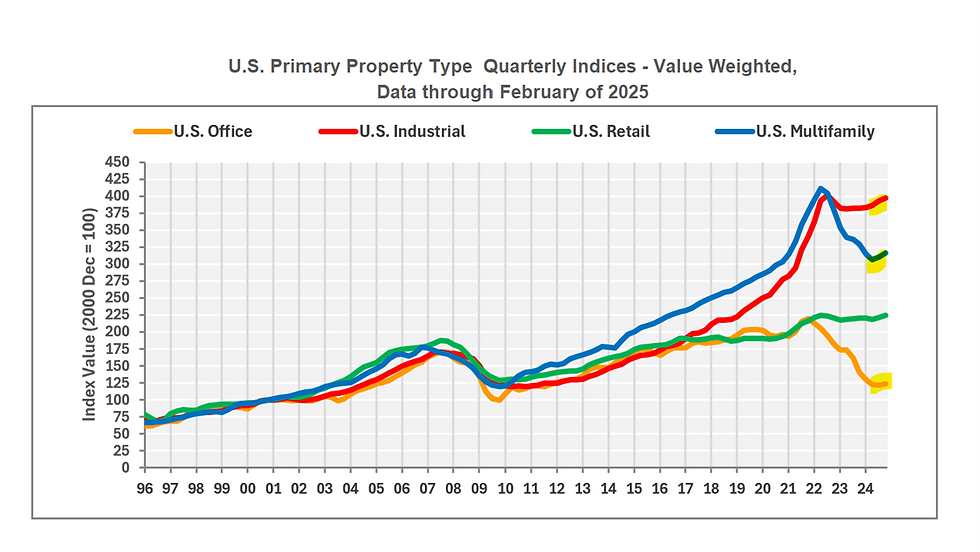

In 2021 – 2022, three of the four major real estate classes entered a downturn. Those were office, industrial and multifamily:

The fourth, retail, was unaffected and has solidly chugged along . (And this behavior stumped those who believed that rising interest increases cause real-estate prices to plummet).

The downturn hit those three affected asset classes with varying intensity.

Industrial went down a small bit for less than a year before bottoming in 2023.

Multifamily dropped substantially for about two years and bottomed in 2024.

Office tanked very badly for 2.5 years and only recently bottomed in mid 2024.

Heading into 2025, all three finally had positive momentum at the same time (and for the first time in years).

So this year is currently shaping up to be a turnaround year for all.

Will existing real-estate properties be the ultimate tariff winners?

Most economists believe that tariffs and trade wars will cause inflation. And this can be negative for many investments.

However, if this happens, then there will probably be both losers and winners (like most trends).

And real-estate already has a long history of being inflation resistant (and a unique ability to often keeping pace with inflation). So that part isn't anything new.

What is unique is that the current situation presents more potential opportunity than usual for real-estate asset classes that were hit hard by supply shocks in the last few years. And specifically for owners of pre-built properties (vs. those building brand new, right now).

Tarrifs eliminating multi-family competition

A recent article in BisNow quoted the cofounder of multifamily investment firm Hamilton Point Investments, talking about tarrifs and saying:

“This will be really bad for developers, really bad for tenants, for residents, but it’s actually kind of good for people like me and for owners of current properties,” Sharp said.

Why?

Tariffs and trade wars are already causing construction prices to soar. And analysts say this is greatly accelerating the death of the pandemic-era new supply bubble (which most say was the main cause of the downturn).

Moody’s Senior Economist Lu Chen said:

“The pandemic fueled a fitful short-term multifamily cycle ... rising demand during lockdowns in 2021 led to an explosion of new construction, much of which came online last year, adding units to markets and weighing on rent growth. …CBRE projects that construction starts at the middle of this year will be 74% below 2021 levels and 30% below the prepandemic average. In the last two years, very little has started, and the developers today are saying there's no equity and the debt doesn't even come close to making new construction work,” Sharp said.

So where do the tariffs come in? Moody’s says:

Early indicators suggest that the U.S. multifamily market is absorbing a record level of new units, and tariffs add another hurdle for developers that could stifle construction. The on-again, off-again tariffs have the potential to add between 3% and 5% to commercial real estate development costs, which CBRE analysts said will add enough variability to pricing that some developers will be forced to shelve projects.

So tariffs would be the knock-out punch to supply, and that's what existing property owners would love to see eliminated.

And Luis Elorza, a Tampa-based principal in Avison Young’s multifamily capital markets group believes this will be very positive for prices:

“It’s an indication that we're at a very interesting inflection point on values. I think we're going to see a dramatic appreciation of multifamily values over the next 12 to 18 months.

And institutions aren’t the only one noticing a potential opportunity. According to a recent survey from Berkadia:

Large, well-capitalized investment firms are still the most active players in the market today, but 83% of large and small multifamily investors are looking to add to their portfolios this year

Will this affect other real-estate types too (and not just multi-family)?

This is an open question and opinions vary. And in theory it could affect all, but in different amounts (varying by how badly the supply glut is hurting them now).

If so:

Retail: As shown in the picture above, retail didn't even suffer a downturn. (So I believe it will benefit less).

Office: Others will disagree, but I believe office will not benefit as much as others.

It's downturn started earlier than the others and has been more severe.

And some analysts say that's because of changes in what workers will accept for mandatory office hours, after Covid-19. If so, a full recovery could take longer to playout.

Mobile home parks:

This asset class has always been remarkably protected and supply-constrained (due to many places not wanting to allow the building of new parks).

So in my opinion, higher construction costs will have little to no effect.

On the other-hand:

Multi-family: As mentioned above, many analysts and industry insiders believe multifamily will benefit substantially.

Self-storage: This asset type has also been suffering badly from a supply glut so could do very well.

However there could also be some complications , and we'll discuss this next.

Other? If you have another real estate type that you feel will benefit please send it to me (and I'll consider adding it to this list).

Self storage: Tarrif winner or loser?

One one hand, self-storage has been suffering from a supply glut. And like multifamily this has been slowly absorbed in recent years as new starts have slowed:

And so existing properties should further benefit from tariffs killing off additional projects in the works.

However, an existing complication is how housing sales will fare. Per Reliant Self Storage, this is an important factor in the population transitions that drive the industry:

"Housing activity plays a crucial role in the self-storage industry, driving demand through population transitions. The three primary sources of demand for self-storage - lifestyle, commercial, and transitional – are all interconnected with housing trends. As we have noted in the past, the demand associated with transitions in the economy and population has been the weakest over the past couple of years.

And recently there's been some positive news here.

Many consumers have been essentially locked into their existing houses due to being unable to buy a new house (and pay a much higher interest rate). And less transitions are bad for self-storage.

Per Reliant:

In recent years there has been concern around the "locked-in" effect of those who own homes with low mortgage rates. As you will see below, the ultra low interest rates from just a few years ago are dropping as a percentage of all mortgages.

And promisingly, active home listings have increased from a low in 2022.

So what's the potential worry? Higher tariffs and inflation might cause interest rates to rise. If it does then the number of locked in homeowners will increase. And that could lessen the industry benefit from decreased supply.

So self storage investors will be watching this very closely.

Bitcoin

Bitcoin ended 2024 with a bang.

The new White House administration ran on a pro bitcoin agenda. So when they won the election last November, the price of bitcoin began to soar. On the day of election, November 5, 2024 the cybercurrency was trading at $69,733. By January it had skyrockted to $109,000.

But today’s it’s tumbled down to around $83,000:

So despite a 19% gain since the election, Bitcoin has fallen 23% from its peak. What’s going on?

Many bitcoin enthusiasts have been disappointed with the changes implemented so far.

For example, the new administration announced plans to establish a strategic cryptocurrency reserve. And this included Bitcoin along with several other crypto currencies (Cardano, Solana, and Ripple). So initially this boosted prices.

Then on March 7, the executive order came out to officialy create it. And MarketScreener reported that it said that “public funds cannot be used to purchase Bitcoins, and in the case of other cryptocurrencies, no further acquisitions will be permitted.” This was a major disappointment to the cryptocurrency community, which expected massive purchases. And this triggered yet another sharp sell-off in the market.

So the question for many is this.

With bitcoin down (a bit) and potential inflation and higher interest rates... is this a bitcoin buying opportunity?

Opinions vary alot by analyst and investors. But at least according to the Motley Fool on Yahoo Finance, it’s not:

Bitcoin, in particular, has been sold as an inflation hedge, but history says it's the opposite.

….Like it or not, cryptocurrencies trade more correlated to growth stocks than they do as a hedge against inflation or the broader economy. In general, low interest rates are good and higher interest rates are bad. In a related note, low inflation is good for crypto and high inflation is bad.

If true, then then the bitcoin slump may have longer to run.

Nice your knowledge sir thanks all of yours