How Will Covid-19/Coronavirus Affect my Alternative Investment Portfolio? Part 26: August 23

Updated: Feb 8, 2021

U.S. makes snail-like but definitive progress fighting second wave of virus deaths; More progress in the Sun Belt beating down second wave of infections; Georgia's economic recovery continues to look mostly painful; "The beatings will continue until morale improves" --unemployment heads in the wrong direction... again; The cleaving of America's two worlds: a tale of two recessions; More cleaving: big company execs award themselves and white-collar workers with a salary boost (in a time of record low-wage job-loss and small business bankruptcy); Financial cliff update: Business execs criticize payroll tax fudge as political agreement remains elusive; The great college coronavirus experiment begins to implode after only a week; Another much hyped coronavirus cure collapses when confronted with a serious scientific study; Study suggests antibodies are back on the table to provide lasting immunity to Covid-19; Pfizer's mRNA vaccine candidate may be approved as early as November; Update on my portfolio.

(Usual disclaimer: I'm just an investor expressing my personal opinion and not a registered financial advisor, attorney or accountant. Consult your own financial professionals before making any financial decisions. Code of Ethics: I / we do not accept any money from any sponsor or platform for anything, including postings, reviews, referring investors, affiliate leads or advertising. Nor do we negotiate special terms for ourselves in the club above what we negotiate for the benefit of members.).

Quick Summary

This week, a lot of the important developments centered around the second virus wave health and economic data, the financial cliff, college reopenings and medical studies on antibodies.

This article is part a multi-article series that's been published weekly since the pandemic began back in March 2020. It started with three introductory articles on the virus, it's effect on the economy and on alternative investment classes. And then it moved on to weekly updates on the latest and greatest developments (along with weekly updates on my evolving personal portfolio strategy). You can see the links to every article in the series here.

U.S. Makes Snail-Like but Definitive Progress Fighting Second Wave of Virus Deaths

For the 23rd week in a row, the United States battled the coronavirus called SARS-CoV-2, which causes the Covid-19 disease. By Saturday morning, the death toll had climbed to 179,805 (versus 172,132 last Saturday morning).

Last week, the country finally appeared to turn a corner battling a second wave of deaths. This new wave had started approximately in mid to late July and had increased for four weeks. Then, last week, it finally plateaued and even had a slight drop. So what happened this week?

This graph is somewhat illegible because of where the European CDC puts the country labels. So let's fix that by zooming in and looking at the section from the start of the second wave to today.

(Note: what looks like a temporary surge between days 104 and 110 is actually just a statistical aberration that resulted when the CDC changed its accounting methodology and then worked through the backlog caused by that change. So we are ignoring that).

This week, deaths mostly treaded water and then had a slight downtick at the end.

So on one hand, this is better than seeing deaths increasing. On the other hand, not much progress happened to actually beat down the second wave.

If we are unable to make clear progress and deaths remain high, then the overwhelming consensus of economists is that this would sabotage hopes of a quick, V-shaped recovery. Instead, the recovery would assume a different shape (W-shaped, U-shaped, etc.) which would be slower, involve more damage to health and economy, and potentially cause problems for some or many consumers, businesses and investments. (See part 14 for more information on the possible "recovery shapes" and their ramifications).

Since this is so important, let's take a look at one of the leading indicators of coming deaths: virus infections. Virus infections tend to lead deaths by anywhere from 2 to 8 weeks (depending on how long it takes someone to die and how long it takes their particular location to report the information). These case numbers are not completely reliable due to testing labs' difficulties in many parts of the country with getting results back on time. But they can still provide a clue of what might be happening later with deaths.

Last week, the country's case numbers were looking a little ambiguous. There was a slight drop from the peak but then they ticked up at the end of the week. How did they look this week?

This week, they unambiguously moved down. So that's a very welcome sign. However, it was only a slight improvement and, so far, it's not yet showing the large progress that will be necessary to truly fight back this wave. But turnarounds can be slow to evolve. So, we'll give it more time and see what happens next week.

World round up

How did other countries do this week?

As we discussed in part six, South Korea uses an aggressive mixture of the Three T's of epidemic control (testing, tracing and treatment). And through most of the epidemic, it has been one of the world leaders in both minimizing deaths (one of the lowest per million) and also minimizing economic damage (their economy is now mostly open and growth is projected to barely shrink this year, while in comparison, the U.S. still has significant closures and is projected to take a -5.9% hit to GDP).

This week, South Korea looked like this:

The country continued to keep their death rate very low compared to the vast majority of the world. For the last 40 days, they have oscillated back and forth between the trough of their first wave and the peak of their second. This week, they oscillated up after 400 infections were previously traced back to a church in Seoul. But this tiny second wave of deaths would still be considered an "A+" result almost anywhere else.

And this week, the South Korean economy continued to remain predominantly open for business.

Meanwhile, Sweden has opted for a lockdown-lite strategy (see part 8). While they've enacted some lockdown measures (they've shut down grade schools, prohibited gatherings larger than 50, instructed elderly people to stay home and young people to work remotely, enacted social distancing rules at restaurants, etc.), they never went into the full-on lockdown seen in many other countries.

The hope has been that if this worked well, it might provide another workable model for other countries looking to deal with the virus. Here's how they look this week:

This week they had a spike of increased deaths. They have always had very volatile numbers, which can make it tricky to interpret their trends in real time. But currently, their numbers suggest they may have hit a trough previously and are now in a second wave. Still, these are at relatively low levels compared to what we saw above in the U.S. And only recently, about a month and half ago, the situation was swapped and they were worse. So, that progress is at least good to see.

Sweden's road to reach this point has been bumpy. The country enjoys a number of unique advantages in fighting the virus that most countries don't have, including an extremely large number of people who live alone, are young and have no children. Despite this, their death rate has been many times worse than other Scandinavian countries (with similar demographics) as well as worse than other countries in general (who lack these advantages). However, they have hoped that if they continue to push down their death curve, they eventually might be able to make up this deficit.

How did Sweden's cumulative deaths look this week? To see, we need to look at deaths per million. Unlike raw deaths, this puts countries of different sizes on an equal playing field. Here's how they did:

Unfortunately, their numbers are still stratospherically bad at 575.29 deaths per million. Compared to its next-door neighbors with similar demographic advantages, it's doing 6 times worse than Denmark (107.21), almost 10 times worse than Finland (60.28) and almost 12 times worse than Norway (48.7). And compared to the best-of-show countries, it's 95 times worse than South Korea (6.03) and almost 2000 times worse than Taiwan (0.29).

Many health experts believe we will likely get an effective vaccine/treatment later this year, and perhaps a rollout to wider populations sometime in mid-2021. If so, then there may not be enough time for Sweden to ever catch up. On the other hand, the Swedish model could still prove itself if other things happen. It's possible we may not get an effective medicine; and/or the pandemic could mutate, leading it to run wilder than expected in 2021; and/or other countries may stumble while Sweden doesn't. We'll continue to watch.

The other big issue for Sweden to overcome is that lockdown lite has thus far been a failure in its main goal: protecting its economy. The country is still expected to plunge into a severe recession (their GDP is projected to be -5.6% in 2020, versus -5.9% for the U.S.). This is a bit better than the average -8.1% projected for the Euro Zone, but is not the large benefit many hoped to see.

But again, if they can sustain their progress on the virus, then their economic outlook could improve as well. For now, it still appears that they've suffered the worst of both worlds (receiving more damage to the economy and to its public health than have others). We'll continue to watch and see.

More Progress in the Sun Belt Beating down Second Wave of Infections

Over the last seven weeks, we watched the second wave of virus infections. First, it started in the Sun Belt and spread to other parts of the country. In response, many states put in place virus control measures, including reinstatements of key portions of lockdowns and rules mandating the wearing of masks (in more than 50% of states). And last week, we saw marked improvements in Sun Belt states like Arizona, South Carolina and North Carolina, which all beat down both deaths and infections. Other states like Florida, Texas and Georgia had more mixed results (with a setback on either infections or deaths). And Kansas also looked potentially troubling.

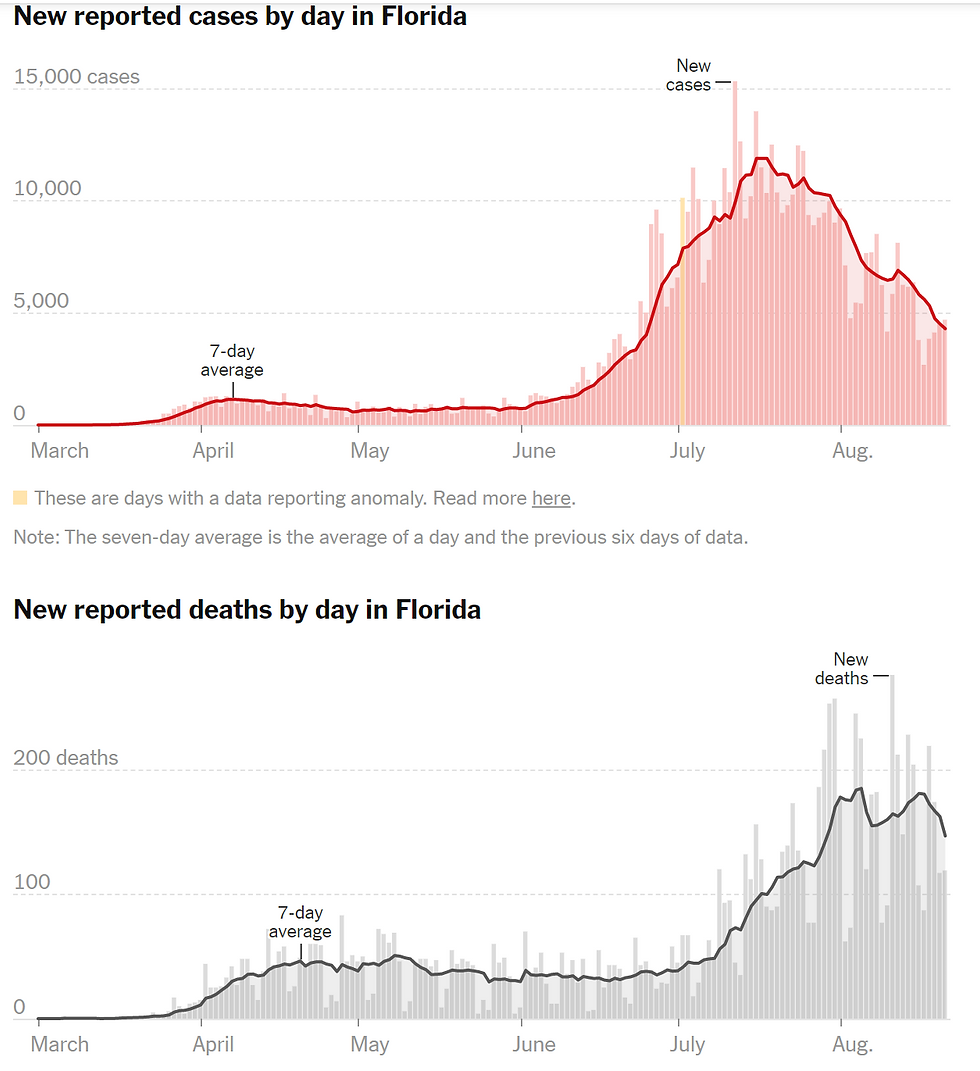

What happened this week? Here's Florida:

While Florida had previously made progress on infections, deaths had remained stubbornly high and had accelerated last week. This week, there was a reversal and a welcome drop. So that was good to see.

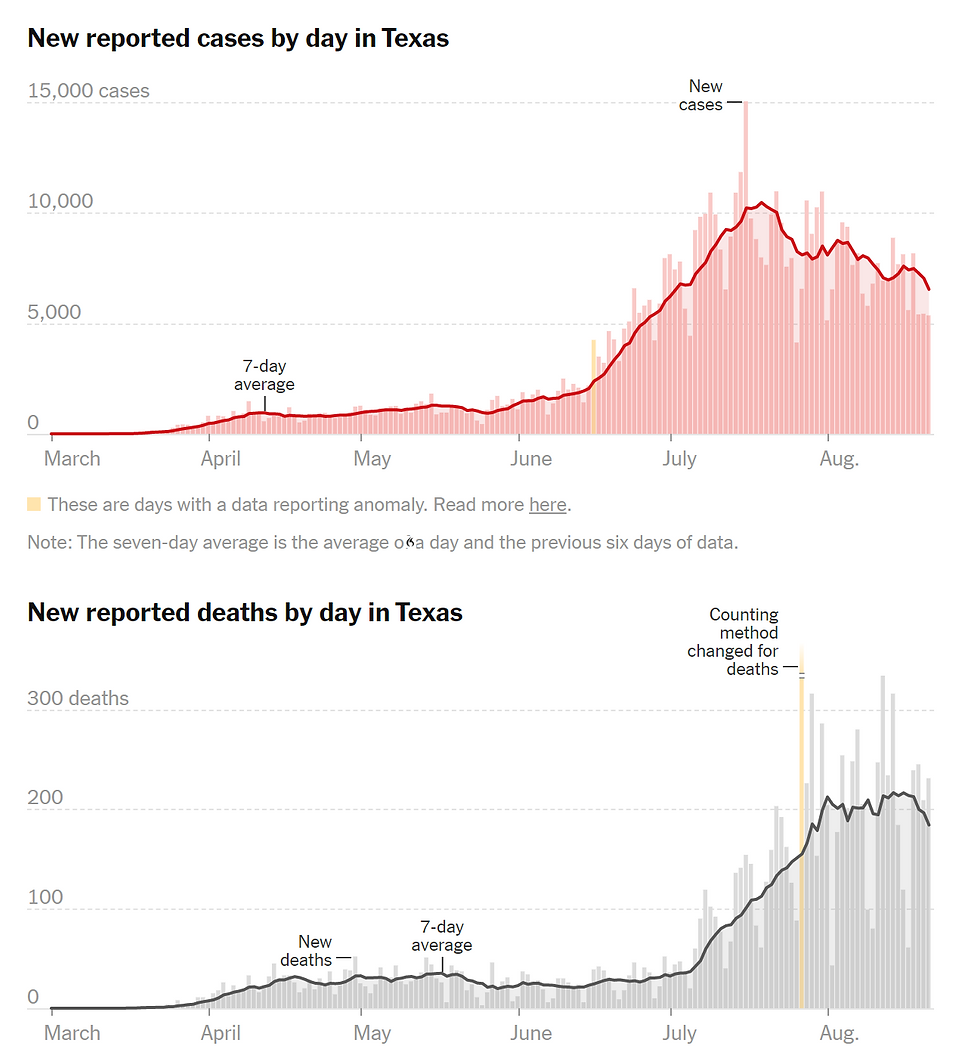

How about Texas? As we talked about previously, the state is undercounting infections because its antiquated systems are not able to incorporate the results of what's estimated to be tens of thousands of antigen tests. So the accuracy there is questionable. But that's are still useful to look at, and previously, deaths had plateaued. What happened this week?

So, this week there was some welcome news, as deaths have now dropped as well.

How about Georgia? They had previously been experiencing accelerating deaths, which was a bad situation. How about now?

This week, they appear to have turned the corner, experiencing a sharp drop for the first time since July. Of note, they also suffered from a smaller but still significant rebound from a large spike at the end of the week. And this marred the results. But, hopefully they're moving in the right direction, and we'll check them out next week.

How about Kansas?

This week, they set a state record for most infections and then had a slight drop at the end. Deaths went down and back up and ultimately ended the week about where they started. So their numbers are looking more troubling, and we'll keep an eye on them.

Overall, the majority of the Sun Belt looks better this week than it did last week: a welcome improvement.

Georgia's Economic Recovery Continues to Look Mostly Painful

One of the most important questions for investments (as well as for the health of the country) is "what will the shape and speed of the recovery be?" If it's V-shaped and quick, then many investments will be just fine. On the other hand, if it's one of the other shapes (U-shaped, swoosh, etc.), then some or many investments could run into problems. (See part 14 for more information on the possible "recovery shapes" and their ramifications).

To monitor the evolving situation, we've been watching Georgia very closely. It was one of the first states to reopen. So we expected this to make it a useful early indicator of what could be in store for some other states.

Back on April 24, Georgia Governor Brian Kemp reopened nail salons, hairdressers, bowling alleys and gyms (as long as they followed state protocols). Then, three days later, restaurants and theaters were allowed to reopen. So they've effectively been open for about four months.

How are they doing? Since there's no official government or state data on this, we've previously looked at Placer.ai. This is a service which tracks mobile phone usage to different types of businesses to measure foot traffic. Again we'll look at how Georgia's Covid-19-sensitive industries did in four areas: restaurants, hotels, retail and fitness.

First let's look at Denny's. It's not known for takeout, so we'd expect it to be more Covid-19-sensitive than a restaurant like McDonald's. Here's how it looks:

It made some slight progress this week, to about -30% foot traffic versus last year. Since restaurants generally have thin profit margins, that's unlikely to be either profitable or sustainable.

Next, let's look at Holiday Inn Express. This is not a luxury hotel. So it might be expected to be a little bit more resistant to a recession than a luxury brand (as consumers downsize). Here's how it looks:

Holiday Inn Express is not looking good, as progress backed up to about -27% foot traffic versus last year. Hotels also don't have huge margins so this currently looks unprofitable and unsustainable.

For retail, let's look at Kohl's. It's somewhat of a discount store so would be expected to do better in a recession than a more upscale brand as consumers pinch pennies. Here's how it looks:

Kohl's is looking a lot better than the last two. True, foot traffic is about -10% versus last year. And before the pandemic hit, this might've been considered a terrible performance that would be suffered only in a recession. But within our current, Covid-produced recession, this graph is actually very good, compared to others.

Finally, we'll look at LA Fitness. This is a traditional gym:

Ouch, that looks horrible at about -58% foot traffic versus last year at the same time. Plus, it hasn't really improved since the middle of June. That looks catastrophically unprofitable and unsustainable.

So overall, progress, for the majority of Georgia's Covid-19 sensitive industries, appears to be stuck in a painful place. The one exception is Kohl's, which is depressed but at least moving in the right direction to recovery.

"The Beatings Will Continue until Morale Improves" ---Unemployment Heads in the Wrong Direction... Again.

For the last 20 weeks, the economy has been hammered with record levels of unemployment. But there was a glimmer of hope last week, as the newly jobless sunk below the 1 million mark for the first time (963,000). And some spoke optimistically of potentially turning a corner.

Unfortunately, the reprieve was brief. This week, the pain ratcheted back as the economy was battered by another 1.1 million jobs lost.

Meanwhile, as we've talked about in the past: at this stage of the crisis, the "continuing claims" is an even more useful statistic to look at within this report. That's because jobless claims give us only half of the picture: how many jobs have been lost. The continuing claims number removes the people who have been rehired from this. And so, that tells us how many are unemployed right now.

This week, continuing claims were 14.8 million. This was a small but continued improvement from 15.5 million last week and 16.9 million the week before. So continued positive progress was good to see. Still, the pace is glacial, and more Americans remain unemployed then at the height of the Great Recession.

Also this week, the nonpartisan Internal Revenue Service (IRS) put out its projections for how long it believes the hit to jobs will last. Unfortunately, the picture was bleak. The IRS believes that, even as far out as seven years from now, there will still be less jobs than there were back in 2019 (i.e., 15.9 million fewer jobs in 2027).

If this ends up being accurate, it would mean a quick, V-shaped recovery won't be in the cards.

Meanwhile, the U.S. Census Bureau put out a report showing new information on the extent of the current damage. As of last month, an astounding half of American households (127 million, making up 50.8%) have lost employment income since March 13.

And more ominously, 35% expect to lose additional income in the next four weeks. (See information on the "financial cliff" in the section below).

The Cleaving of America's Two Worlds: A Tale of Two Recessions

We've talked in past weeks about how Covid-19 has hammered certain groups much worse than others. Low wage earners and minorities are disproportionately more likely to work in public-facing industries and live in more cramped quarters that facilitate the spread of the virus. And as a result, they've died at startlingly higher rates than other groups.

This week, a string of data came out showing that health risks aren't the only problems for these groups. So far, they're also taking the brunt of the economic carnage on the chin, too.

First, the U.S. Census Bureau reported that as of the end of last month, low-wage workers making $25,000 or less were a disturbing 15 times more likely to have missed a rent payment, versus high wage workers making $200,000 and above (30.2% vs. 2.8%). Minorities were also severely impacted, with black renters being twice as likely to have missed a rent payment as whites (31.5% vs. 14.5%):

Also this week, the Federal Housing Administration (FHA) released data on mortgage loans. Typically, these are used by first-time buyers, minorities and low-income Americans who are looking for a more affordable path to homeownership. And the FHA reported that late loans skyrocketed from 9.7% in the previous three months to an eye watering 16% in the second quarter. This set an all-time record for the worst numbers since the information was first recorded back in 1979 (which includes the Great Recession).

In comparison, conventional loans were at a 6.7% delinquency.

Why the discrepancy? Analysts noted that low-income workers are most likely to work in the service jobs hardest hit by the recession including hospitality, travel and retail. And as we've talked about in past weeks, millions have lost jobs, been furloughed and/or seen their hours cut. And more recently, the unemployed have taken an additional hit with the loss of the temporary $600 a week unemployment benefit (see next section on "financial cliff").

In contrast, many white-collar professionals outside of those industries have been largely unaffected. So this has created a strange divide in the country where the two groups are predominantly experiencing a very different reality.

How will this end up playing out?

On one hand, there's the possibility this divide will narrow. Ultimately, all jobs are tied together in the economy. So if enough low-wage workers take sustained hits and stop spending, then theoretically this should eventually start hurting businesses employing high wage workers and cause the damage to spread.

On the other hand, past recessions ultimately turned out to be much harder on some groups than others. For example, in the Great Recession, earners in the top decile saw an income loss of less than 10% while the bottom decile were hit more than twice as hard.

Or, we could see a combination of both.

If this recession and its recovery end up affecting people in very unequal ways, most political analysts predict we will see significant medium and long-term consequences.

For example, the Great Recession caused seismic changes that are still reverberating today. The massive discontent caused a dramatic rise in populism. And today, populist ideas are mainstream, not only in both U.S. political parties, but also in countries around the world (from Hungary to Brazil to the U.K).

So, if we do get an unequal final outcome, many political analysts expect even more mass discontent, further social unrest and unpredictable medium-term and longer-term consequences.

More Cleaving: Big Company Execs Award Themselves and White-Collar Workers with a Salary Boost (in a Time of Record Low-Wage Job-loss and Small Business Bankruptcy)

In another example of the differences between America's two economic worlds, numerous companies made announcements this week concerning salary boosts. Many of the largest companies, including Walt Disney, General Motors and Yelp, will be reversing previous pandemic cuts and hiking executive pay and white-collar worker salaries.

For example, Disney announced that it will lift its previous pandemic salary reductions on executives on August 23. This is despite posting a nearly $5 billion loss and laying off or furloughing thousands of low-wage workers.

Oil producer Occidental Petroleum reported a few weeks ago that it would also double the salaries of some executives. They had been capped at $250,000/year early in the pandemic, but will be increased to $500,000 in a partial restoration. As discussed in previous weeks, the U.S. oil industry has been pounded by a combination of unsustainably low oil prices and high debt, which has resulted in the layoffs of tens of thousands of lower wage workers.

Not all the hikes have been for executives. Some companies are starting to realize that they can't expect to pay part-time wages for full-time white-collar employees who are often working at home juggling work and kids. Yelp had laid off 1000 white-collar workers and furloughed more than 1100 in the spring. Last month, they announced they would bring back nearly all the furloughed workers and fully restore employee pay and hours.

And some companies announced pay increases for both executives and white-collar workers. This week, Virginia hospital operator Sentara Healthcare announced that in October it will increase the pay of senior executives by 20% and physicians by 10% (after decreasing by the same amount previously due to the pandemic).

According to the Healthcare Financial Management Association, an industry financial group, U.S. hospitals and health systems lost $202.6 billion in the year to date as they were hammered by the loss of revenues from patients who put off elective surgeries and noncritical healthcare. They also project a slow recovery for the industry, with 89% of executives believing revenues will not have recovered to pre-pandemic levels by the end of 2020.

Financial Cliff Update: Businesses Execs Criticize Payroll Tax Fudge As Political Agreement Remains Elusive.

As we discussed in past weeks, much of the country is falling off the edge of a very painful financial cliff. And if it isn't resolved, there could be significant pain coming up for consumers, businesses and investors in virtually every alternative investment asset class (especially real estate and private equity).

Why does the cliff exist? Well, so far, the economy has taken unprecedented amounts of damage through record-setting unemployment. And normally, this would already have resulted in widespread pain across the economy. But, while there has been substantial damage in specific sectors (like hotels, travel, etc.) this hasn't spread widely yet (for example, into apartments, office, self storage, mobile home parks, business loans, etc.).

That's because, as part of the $3 trillion Covid-19 stimulus package, unemployed workers were receiving an extra $600 per week. Additionally, many citizens got free stimulus checks of $1200 per person (and $500 per child). Also, governments at the federal, state, and local levels have passed moratoriums on evictions and foreclosures to keep unemployed people housed in their homes. None of these programs was perfect, and we talked in past weeks about how snafus caused millions to be unable to get deserved and needed aid. But still, these programs have contained untold amounts of damage.

Now, however, the problem is that the $600 unemployment payments expired two weeks ago, the stimulus payments were a one-time event, and many of the moratoriums have expired. The original thought was that the pandemic would be long gone by now. But obviously, we now realize, that was overly optimistic. And, if the government does not pass new stimulus, many consumers will fall down a painful economic cliff. And if so, they are expected to drag down businesses and investors along with them.

Unfortunately, the two major political parties in the White House have not been able to come to an agreement on this. One party passed a $3.5 trillion stimulus bill, and the other was unable to get enough agreement from its own members to pass a counter bill. As a result, the second party tried to reach across the aisle, but they were still unable to get an agreement.

So two weeks ago, the president passed four executive orders to unilaterally address the issue. Some of these were criticized by lawmakers in both political parties for being unconstitutional (since they appropriated new money without Congress's permission). These consisted of:

Delaying payroll taxes from September 1 to December 31: This week, roughly 30 industry groups, led by the U.S. Chamber of Commerce, protested the order. Since a president lacks the legal authority to unilaterally issue a tax cut, the order was forced to leave employers on the hook if employees don't voluntarily pay the taxes back. The businesses complained the plan is "unworkable" and concluded: “Therefore, many of our members will likely decline to implement deferral, choosing instead to continue to withhold and remit to the government the payroll taxes required by law,” the groups wrote. As a result, analysts are expecting no positive benefit from this order.

Replacement of the $600 per week unemployment: the order said this would be done with a $400 per week unemployment check, with 75% coming from the federal government and 25% from the states. However, the order diverted money from a fund that Congress has not approved for this use (in a process that both parties have claimed is an unconstitutional power grab). And, the fund that was raided is extremely small and will run out next month. Additionally, several states complained that they are already cash-strapped from the pandemic's damage to tax revenues, and have no money to provide their portion. As of this week, only four of the 50 states (Arizona, Iowa, Louisiana and New Mexico) had approved the payouts and said they would do it. As a result, most of the unemployed are currently taking a $300 a week loss in unemployment income versus what they had last month. And a small minority is taking a $200 a week loss. And these payments are not sustainable past September.

Extended eviction and foreclosure moratoriums: this would theoretically be very helpful for the unemployed, but the Executive Order did not go so far as to actually require this. It simply asked certain people to examine the possibility of doing so. So currently, this is not expected to provide any economic benefit.

Suspend student loan payments until December 31. These were already suspended until September 30 under current law. So while they will provide a benefit after that, they will not be making any real difference until then.

So overall, the executive orders are considered by the vast majority of analysts to be too little to effectively address the financial cliff.

And this week, there was no progress made on negotiations between the two parties and the White House on further legislation. So the standoff continues.

The Great College Coronavirus Experiment Begins to Implode After Only a Week

On August 1, we talked about how a YMCA summer camp that followed all Georgia safety precautions was overrun with coronavirus. It was forced to shut down, just over a week after 260 campers and staff became infected.

Then on August 8, we discussed how grade schools that tried to reopen in-person classes ran into similar problems. Several schools in Georgia as well as Kansas and Mississippi were overrun and forced to shut down in-person schooling and switch to online.

Some health experts warned that colleges could potentially be even more at risk than grade schools. In addition to having many of the same risks, they also have a culture of after-hours socializing and consumption of alcohol. And both these activities discourage students from social distancing and from taking health precautions like wearing masks.

Still, an analysis by Davidson College, found that 23 of the 100 major public universities chose to hold classes primarily in person, or offered a hybrid solution that included at least some face-to-face interaction. And many of these schools started their public health experiment last week.

So how's it going so far?

The University of North Carolina at Chapel Hill is one of the largest schools in the nation to go in-person. On Monday, the school reported that after less than a week of classes, it would need to shut down all in-person instruction and shift to remote. In just that short span of time, it had already reported a startling 135 new cases with multiple clusters of infections. Its positive test rate skyrocketed from 2.8% the prior week to 13.6%. And 349 people were required to quarantine, which used up 95% of the rooms that had been set aside for an on-campus quarantine.

Over the summer, UNC had brought its fall athletes back to campus, including 100 football players. Less than a month later, 37 people were infected, including players, staff and coaches, and the camp had to be put on pause.

This time around, county health officials warned UNC of the health risks, but school administrators insisted on going forward. UNC leadership claimed they would avoid any problems by spreading students out and maintaining just a 60% occupancy.

When the experiment was unceremoniously shut down on Monday, the Chancellor Kevin M. Guskiewicz and Executive Vice Chancellor and Provost Robert A. Blouin wrote: “As much as we believe we have worked diligently to help create a healthy and safe campus living and learning environment, we believe the current data presents an untenable situation.”

Meanwhile, in Indiana on Tuesday, Notre Dame announced it was shutting down its in-person classes for at least two weeks, after it was also hit by a rash of infections. The day before, which was exactly a week after classes had started, 80 students out of 418 tested positive for infections, for a 9% positivity rate. By Tuesday, the total positivity rate had skyrocketed to 16%. Multiple clusters were linked to at least two off-campus parties.

Notre Dame had set up a much vaunted testing system as part of its plan to bring students on campus. All of the nearly 12,000 students were tested before being allowed to start class. And out of that group, only 33 students (0.28%) tested positive, so the school believed it was in great shape. The school also stockpiled 10,000 gallons of hand sanitizer and posted 50,000 signs reminding students to wash their hands, which it believed would be effective in stopping the spread.

On Tuesday, Notre Dame President Rev. John Jenkins said, “The virus is a formidable foe. For the past week, it has been winning. The objective of these temporary restrictions is to contain the spread of the virus so that we can get back to in-person instruction.”

Currently, students are staying on campus, but are confined to learning via online sessions from their dorms. If the outbreak isn't contained within the next two weeks, then the school will send all students home to learn remotely.

Meanwhile, later on Tuesday in New York, Ithaca College announced it was reversing course and will not bring students back to campus. Then later that day in Pittsburgh, Carnegie Mellon announced it would start remotely for the first week.

Finally, on Friday in North Carolina, NC State University announced that it was also shutting down its in-person classes and moving online. The school had suffered multiple clusters of infections, which contributed to 90 new infections being reported on Thursday alone.

Another Much Hyped Coronavirus Cure Collapses When Confronted with a Serious Scientific Study

Actemra (also called thattocilizumab) is a a rheumatoid arthritis treatment. It's called an interleukin-6 inhibitor, and many had theorized it should be an effective Covid-19 treatment. After all, it's been known to reduce inflammation. So this "should" allow those hit by the virus to recover faster, breathe without a machine, and eventually heal.

Earlier this month, a study by Boston Medical Center set hopeful hearts aflutter. It found that Actemra reduced the death rate of Covid-19 by an amazing 45% to 50%. If true, this would be a major breakthrough. An article in BGR breathlessly announced, "Doctors think they found the most effective coronavirus drug yet".

However, in all the hype, many missed the fact that the BMC study was just an observational study. And as we've discussed in past weeks, this means it only suggests a connection (a correlation between taking the drug and stopping the patient from dying). It doesn't actually prove it. And the only way to get proof is to test the theory with a robust, large, scientifically sound study (i.e. randomized, double-blind placebo study). Until then, it's just a promising theory. (And this is why I didn't even bother discussing the announcement about Actemra when it came out).

Back in May and June, we saw how hydroxychloroquine got tripped up in this dynamic. The drug looked very promising in multiple small and/or non-scientifically sound studies. And then a big study showed that it didn't work... but errors were found in the big study during peer-review. So that study was retracted and it meant there was still hope. But on June 6, the nail in the coffin came when a peer-reviewed, huge 11,000-patient Oxford University study found it was no better than a placebo. And this was later confirmed by another study.

The bottom line is that initial studies are highly speculative and can easily turn out to be wrong.

This week, it was Actemra's turn to jump on the same ride. Roche, the manufacturer of the drug announced that the drug flunked its phase 3 human trials. Specifically, the drug neither improved the condition of Covid-19 nor prevented deaths any better than a placebo (a fake pill).

However, there was one silver lining. Patients using Actemra recovered in 20 days versus an average of 28 on placebo, which suggested it might speed recovery for those who do survive. So Roche said they would continue to study the drug. They also said they would try combining it with other drugs (like an antiviral), which might produce a more compelling treatment than Actemra on its own.

Study Suggests Antibodies Are Back on the Table to Offer Lasting Immunity to Covid-19

One of the biggest mysteries about the virus concerns how the immune system fights the disease. The body has multiple tools to fight invaders. It produces antibodies (Y-shaped proteins) which try to latch on to the virus and kill it. It also produces T-cells, which also attack viruses. But which one is more important to helping a patient recover? And whichever one(s) is, can it stop a person from being reinfected? And if so, how long do these defenders stick around to offer that protection?

Right now, we don't know any certain answers to any of those questions. But they are hugely important because they will determine if a vaccine is possible and how effective it will be. And that will most likely be key in determining whether the pandemic will end sooner, or later.

On July 18, we talked about how several studies suggested that antibodies peter out surprisingly quickly. A study from College of London and another one from Chinese scientists both concluded that the vast majority of people no longer had potent levels of antibodies just 2 to 3 months after infection. This could mean that an effective vaccine might be impossible to create. Or it could be very difficult, requiring multiple doses and/or have to be taken very often. So this was a disappointing and also surprising result since antibodies have been found to stick around in other coronaviruses (like SARs) for a year and a half and longer.

Then on July 25, Sweden's Center for Infectious Medicine reported that twice as many Covid 19 patients have T cells versus antibodies. This suggested that maybe T-cells were a better focal point in the search for an effective vaccine. So that was a potentially promising new lead.

This week, there was some additional news on the antibody front. A study (which has not yet been peer-reviewed) was released, showing results from observations of 5,882 people. It claimed previous antibody studies suffered from fatal flaws, which made their results inaccurate. Specifically, the immune system typically starts off producing antibodies with a wave of short-term plasma cells. But these are then replaced by longer-term antibody secreting cells. What this means that the decay of antibodies isn't linear and if the studies looked at the wrong time, they would miss this replacement.

Also, the study pointed out that there are known false negative/false positive issues with antibody tests. If these were not accounted for, it might have skewed earlier experiments. The researchers claimed that they came up with additional techniques to counteract this and make them more accurate.

And the scientists claimed that after making these adjustments, they found that actually, even 2 to 3 months out from the disease, the vast majority of people are still producing lasting antibodies. Additionally, to check the effectiveness of the antibodies, they exposed the recovered persons to live versions of the virus. When they did, the antibodies successfully attacked the virus.

If accurate, this would suggest that use of antibodies may be back on the table for an effective and long-lasting vaccine. And if so, that would be positive news.

Even if this study is accurate though, what we really need to see is that the antibodies are lasting for a year or more. The answers will have to wait on follow-up studies, which are currently underway and studying patients for longer time frames.

Meanwhile, another promising study also came out this week regarding immunity against SARS-CoV-2. A fishing vessel with 122 people on board was hit with a super spreader event that infected a startling 104 of them.

What's unique to the study is that 120 of those people received follow up testing for an average of up to 32.5 days. So this allowed very close tracking of what happened later. And what the research discovered is that the three people who had antibodies prior to boarding (had previously caught Covid-19 and recovered prior to the trip) did not test positive after joining the infected people on the boat, and did not show any symptoms of reinfection.

So while this is a very small sample size, it seems to also suggest that antibodies (and/or possibly T-cells) may in fact work to fight off a potential repeat infection. If so that would also be very good news.

Pfizer's mRNA Vaccine Candidate May Be Approved As Early As November

Meanwhile, Pfizer announced that it's on track to receive regulatory review of its vaccine candidate in October. Analysts estimated that if the vaccine passes phase 3 human trials, this would put it on schedule for approval as early as November.

We discussed Pfizer's mRNA vaccine (BNT162b1) in detail back on July 4. Then on July 5th, we talked about how Pfizer was awarded up to $1.95 billion for the drug from Operation Warp Speed (OWS). OWS is a government initiative to speed up development, manufacturing and distribution of an effective vaccine or treatment.

If the vaccine passes all tests, the contract would pay Pfizer to provide 100 million doses of the vaccine to the U.S. How long it would take Pfizer to manufacture this quantity after a theoretical approval in November has not yet been disclosed.

But we do know that the vaccine is expected to have a two dose requirement. So that means the purchased doses would cover about 1/6 of the U.S. population (which is 328 million in total).

This appeared to echo what top U.S. administration officials, including National Institute of Allergy and Infectious Diseases Director, Anthony Fauci, said last week. They warned that even if any of the vaccines are successful, they are not expected to be given to everyone right out of the gate. Instead, priority would be given to high-risk groups. As a result, Fauci said that most Americans would not be expected to receive a vaccine until well into 2021.

Pfizer has gone forward with setting up three manufacturing plants in the U.S. and others in Europe. If trials are successful, this would allow them to ramp up further and by the end of 2021 create up to 1.3 billion doses for distribution around the world.

Update on My Investment Strategy

Every week, I take a look at the latest developments and data and reevaluate my personal outlook on the possible economic scenarios and my personal investment strategy. This week, I've made some updates and added a new investment strategy to my portfolio (an N95 manufacturing company). But fundamentally, it's the same as last week.

Treatment: I believe chances are good we'll have an effective medicine for Covid-19 (i.e. antibody treatment, vaccine, etc.) by fall or winter of this year. And with some luck we could even have more than one. Unfortunately, it's also unlikely it can be manufactured and distributed in large enough quantities to immediately treat everyone who wants and needs it, until well into 2021. If that happens, then it will not be enough to super-charge the economy right away. And there may be potentially huge quality-of-life difference between the treatment-haves and treatment have-nots. This will be divisive and exacerbate existing tensions in our society and world between both rich and poor citizens and countries.

Recession? We've already had one quarter of negative growth in Q1 (-4.8%) and Q2 will be record-breakingly bad. So a technical recession (2 consecutive quarters of negative GDP growth) is inevitable.

Shape of the recovery: In part 14, we talked about how the shape of the recovery (V-shaped, U-shaped, swoosh-shaped, W-shaped, L-shaped, combo-shaped etc.) will have a huge effect on the ultimate outcome of many different investments. So far, pretty much everything that's happened has been much worse than the consensus expected. Pretty much no one saw the lock-downs coming back in February. More people have been killed than originally projected. Many more than expected have lost jobs. The stimulus and unemployment aid was enormous, but has too many unexpected holes and isn't getting to millions who need it the most. States reopened but were forced to backtrack. Many businesses have reopened but customers are staying away. So unfortunately, I don't think a quick, V-shaped recovery is going to happen. I would love to be wrong. I'm getting more and more concerned about a very damaging "W", which could come from the second and/or third waves of the virus. Unfortunately this is looking more and more likely. My slim hope is that, as of this week, the second wave is at least starting to come under control. So if this can be maintained, avoiding a 3rd wave from school openings and cooler weather.. and if the US government also passes a generous stimulus law, then the worst effects of the additional waves could be mitigated. That's a lot of "if's"...so we'll see. And I'll continue to monitor the data very closely. Currently, I still believe we will have a three stage combo-shaped recovery that starts off (1) quickly as the first "easy" industries and companies come back online (i.e. v-shaped). But (2) this will peter out as the more difficult ones are unable to return and a slow swoosh will become apparent. If we get a second (or third) lock down then this step (2) will become W-shaped and more painful. Then in fall/winter, (3) I believe we will probably see a treatment and/or vaccine. And if we do, then that would be the trigger for the third stage and an accelerated recovery. But this most likely won't be a straight-V recovery because it will probably take time to ramp up production and delivery to enough Americans to get herd immunity (not until well into 2021). So the boost will be slower and smaller at first. Also, if the first generation medicines are significantly less effective than 100% (which many health experts believe will be the case), the boost will be even smaller. (All of this will depend on which treatment makes it that far... which we don't know at this point). But we also could get a little lucky (for example, if the successful vaccine treatment is a newer type that can be scaled up more quickly or is more effective). If so, then the third stage boost would be faster. If I'm wrong, and we don't get a treatment or vaccine this year, then the economic damage caused by long-term job loss and wage cuts will most likely be severe, and will further exacerbate (and slow down) whatever type of recovery we do get. That would probably be ugly for the majority of all investments. So let's hope we don't have to find out how that scenario would play out.

Investments: If the above is roughly correct, then it will unfortunately be painful for many individuals and some investors. And some sub-sectors of alternative investing (like certain real estate classes) will come under heavy stress. Many may fold in the coming months. At the same time, I think there will also be an opportunity to purchase dislocated and distressed assets at very favorable pricing and significant discounts. And I believe that patient, discerning investors may be able to take advantage of once-in-a-decade or once-in-a-generation opportunities.

Strategy:

No new investments in real estate or any asset classes that are correlated with the unemployment or the business cycle until there is more clarity about the unknowns concerning the virus and the upcoming financial cliff.

Invest in assets that are coronavirus resistant (and uncorrelated with the business cycle). That includes:

Music royalties (which can actually do better in lock-downs due to increased streaming).

Life settlements (which actually perform better when people are dying faster and in any event isn't directly tied to the business cycle).

Litigation finance (which performs based on winning or losing cases and also isn't directly tied to the business cycle).

Invest in coronavirus "portfolio insurance" (i.e. an investment that would be expected to do better the longer coronavirus continues or if it gets worse).

N95 Mask Manufacturing Company. If the pandemic should disappear tomorrow (which I personally am not counting on), I would be happy to take a small loss here given that the rest of my portfolio would be doing extremely well. On other hand, if Covid-19 doesn't disappear and things go as I expect (or worse), then this investment could provide a welcome profit boost and improve my diversification.

Continue to hold cash and be patient for dislocated and distressed opportunities. The worse the economic damage, the more chance there will be for those once-in-a-generation or once-in-a-lifetime opportunities.

My opinions and strategy will change if we get some better or worse news on the science side or in some of the other X factors.

For example, a new stimulus law could shift things in a more positive direction. And, as I mentioned above, the virus getting out of control again in large areas and forcing large lock-downs a second or third time, could easily make things worse.

Next article

Covid-19/Coronavirus Affect my Alternative Investment Portfolio? Part 27: August 30

U.S. makes more slow progress battling second death wave, but road-bump may loom ahead; World round up: trouble in Spain; After sunbelt finally gets control of second wave of infections, midwest appears to stumble along same path toward it's own second wave; Georgia's Covid-19 sensitive businesses remain mostly comatose. And ominously, once impervious grocery-stores take a hit; Economy hammered yet again by massive unemployment, as flood of companies announces future layoffs; Financial cliff update: More fiddling while Rome burns.; Where are the loans? Much vaunted U.S. stimulus is a $1.8 trillion dud; US commercial real estate transaction plummets. Is the worst yet to come?; Caught covid-19 and now think you're 100% immune? Think again. Multiple Scientists around the World Document That It's Possible to Catch Covid 19 Twice. Update on my portfolio. Go to next article.

Commentaires